How does tax on bonuses work?

Explaining how bonus tax calculations work and why it looks like you pay so much more tax on it.

Why do I pay so much more tax on my bonus than on my salary?

Short answer: You're not.

Long answer: Read on. Let us deep dive into what is actually happening.

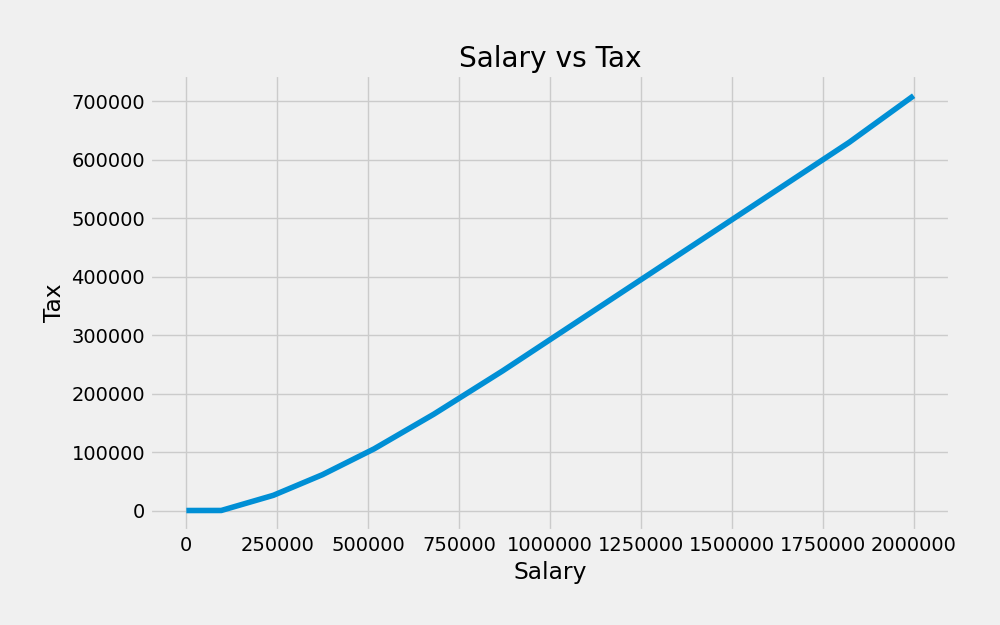

Take a look at the chart and table below, which show the ratio of taxes paid to your salary.

The graph and table above show that the more money you earn, the more taxes you pay. This increase is gradual and smooth, rather than a sudden jump from one tax bracket to the next. The tables are set up in a way that makes the transition from one bracket to the next seamless. This means that even if you move into a higher tax bracket, you won't suddenly be hit with a much larger tax bill - the increase will be spread out gradually. So, don't be afraid of earning more money, as the tax increase will be manageable and won't drastically impact your overall income.

If you receive a bonus, it may seem like you're paying more in taxes because it's a larger amount of money. However, this is not actually the case. The reason it may appear this way is the bonus is usually paid in a single lump sum, whereas your regular salary is spread out over the year. If you were to divide the bonus amount by 12 and add it to each month's salary, you would end up paying the same amount of taxes in total. So, while it may feel like you're paying more taxes on your bonus, it's actually just the result of how the payment is structured and your increased yearly income.

The table below shows the two examples laid out side by side. Both earn the exact same yearly income, but the one on the left earns it as 12 salary payments and one 13th bonus payment. The one on the right receives the same total, but just in 12 salary payments.

| Month | Salary + Bonus | Tax | Salary | Tax |

|---|---|---|---|---|

| March | R 36 000.00 | R 6 599.00 | R 39 000.00 | R 7 529.00 |

| April | R 36 000.00 | R 6 599.00 | R 39 000.00 | R 7 529.00 |

| May | R 36 000.00 | R 6 599.00 | R 39 000.00 | R 7 529.00 |

| June | R 36 000.00 | R 6 599.00 | R 39 000.00 | R 7 529.00 |

| July | R 36 000.00 | R 6 599.00 | R 39 000.00 | R 7 529.00 |

| August | R 36 000.00 + R 36 000.00 | R 17 759.00 | R 39 000.00 | R 7 529.00 |

| September | R 36 000.00 | R 6 599.00 | R 39 000.00 | R 7 529.00 |

| October | R 36 000.00 | R 6 599.00 | R 39 000.00 | R 7 529.00 |

| November | R 36 000.00 | R 6 599.00 | R 39 000.00 | R 7 529.00 |

| December | R 36 000.00 | R 6 599.00 | R 39 000.00 | R 7 529.00 |

| January | R 36 000.00 | R 6 599.00 | R 39 000.00 | R 7 529.00 |

| February | R 36 000.00 | R 6 599.00 | R 39 000.00 | R 7 529.00 |

| Total | R 468 000.00 | R 90 348.00 | R 468 000.00 | R 90 348.00 |